Transforming Westpac’s Consumer Mortgage Experience

Overview

Westpac is currently undergoing a comprehensive transformation of its digital consumer mortgage process, aiming to deliver a seamless, end-to-end experience for home loan origination. This initiative spans user research, product strategy, and design development, addressing both customer-facing and back-office challenges.

Role and responsibilities

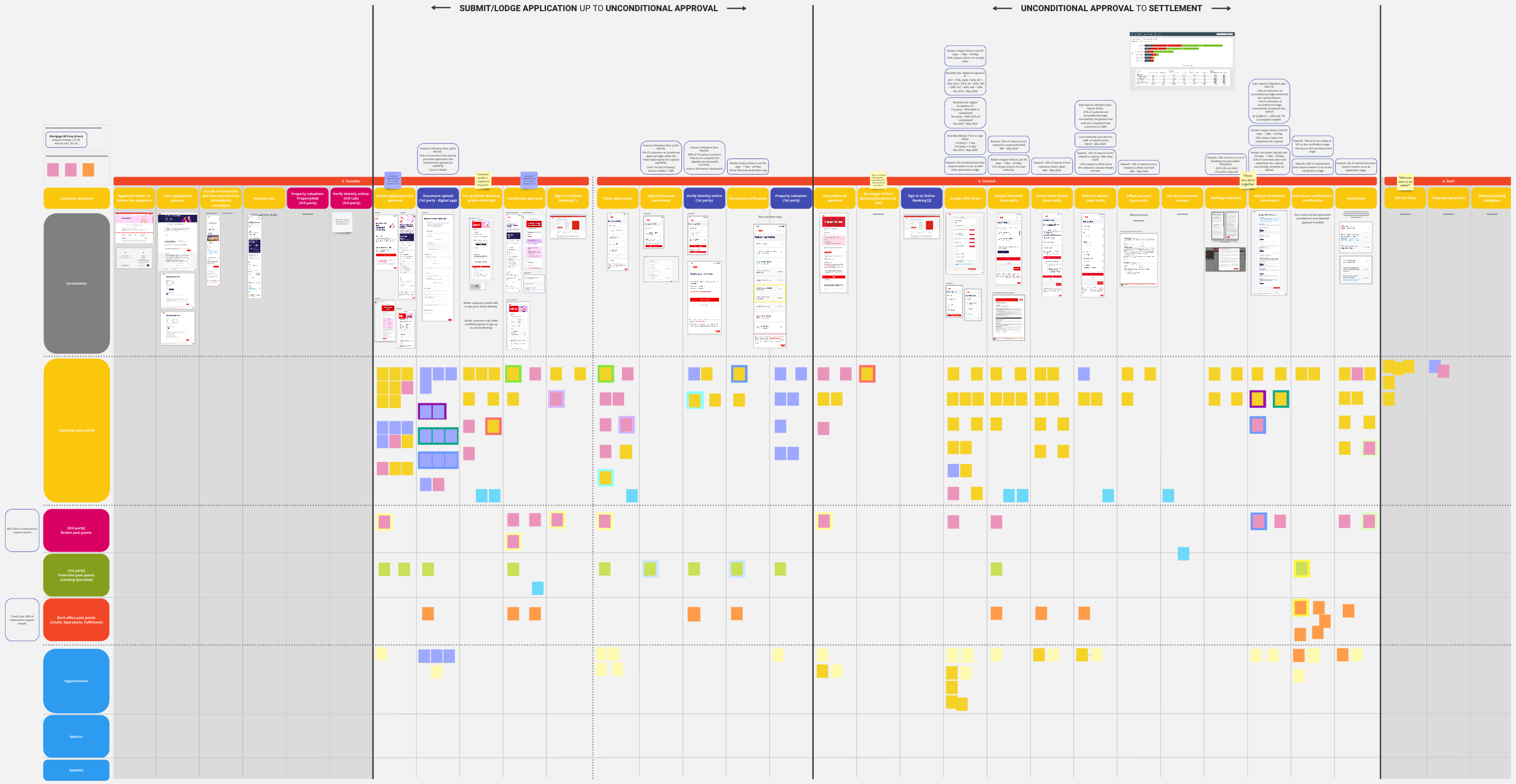

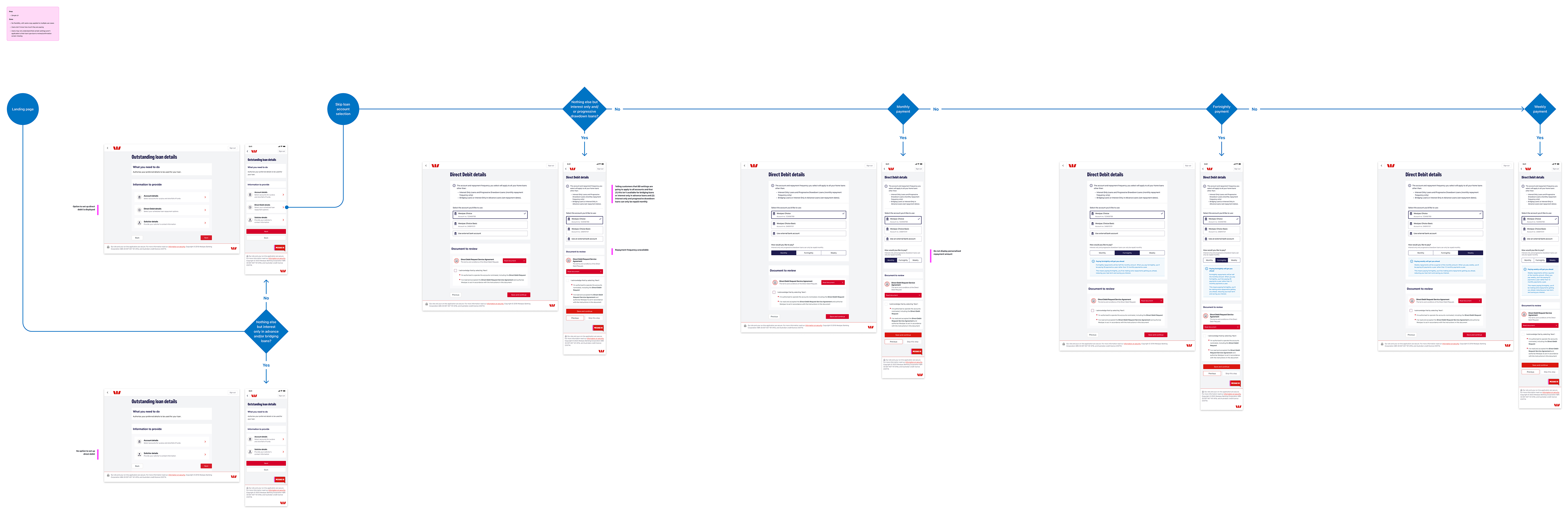

I’m leading the transformation across five workstreams, ensuring alignment with user needs, business goals, and technical feasibility:

- Release train – directing the core design work and implementation of key features across multiple releases

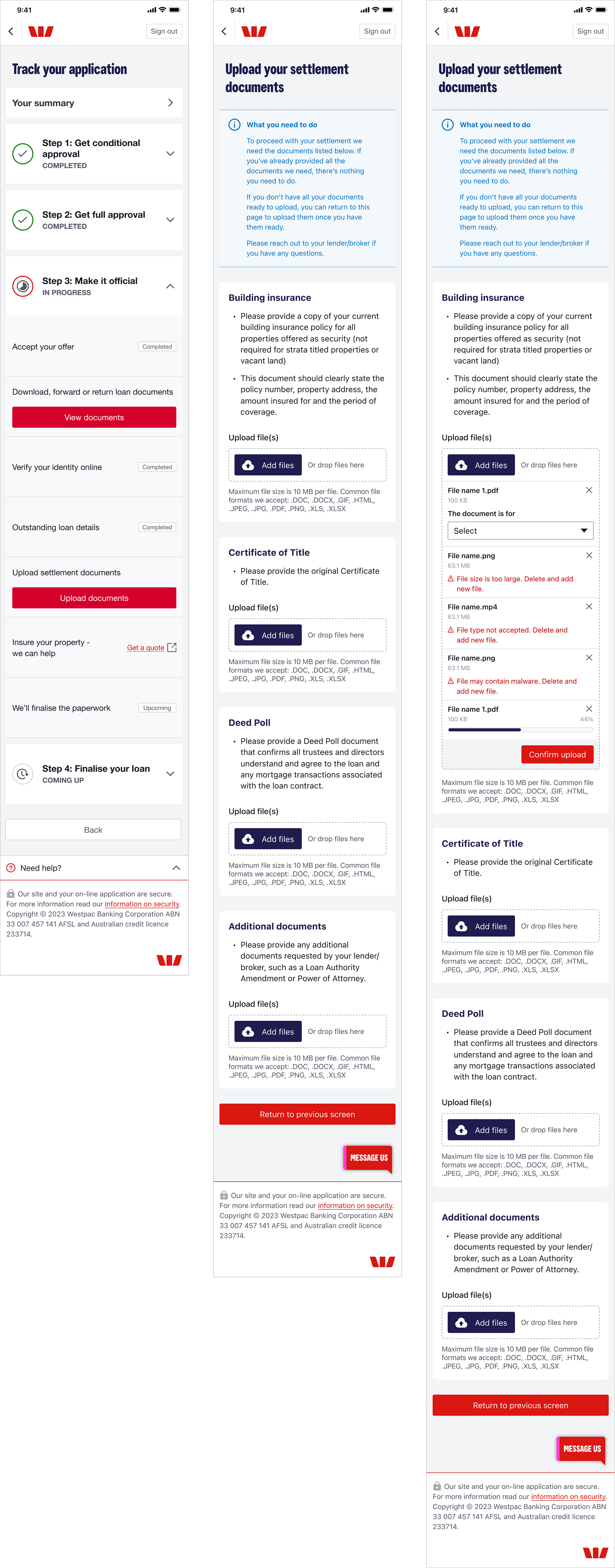

- Research & testing – conducting iterative user research and testing to gather feedback and refine the end-to-end journey

- Design enhancements – identifying opportunities to optimise the current state and define future-state experiences

- Content design – delivering clear, customer-centric content that meets accessibility, legal, and security requirements

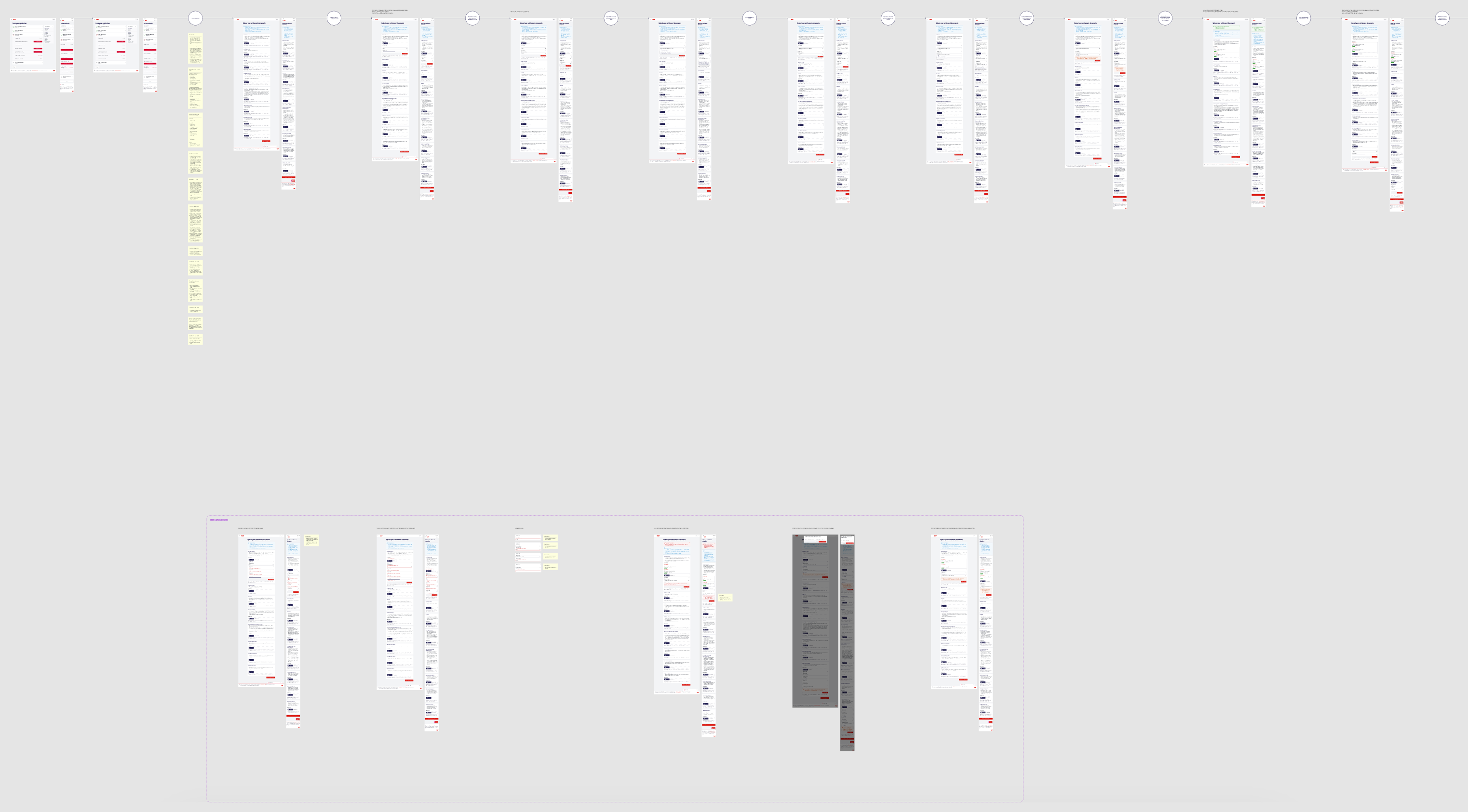

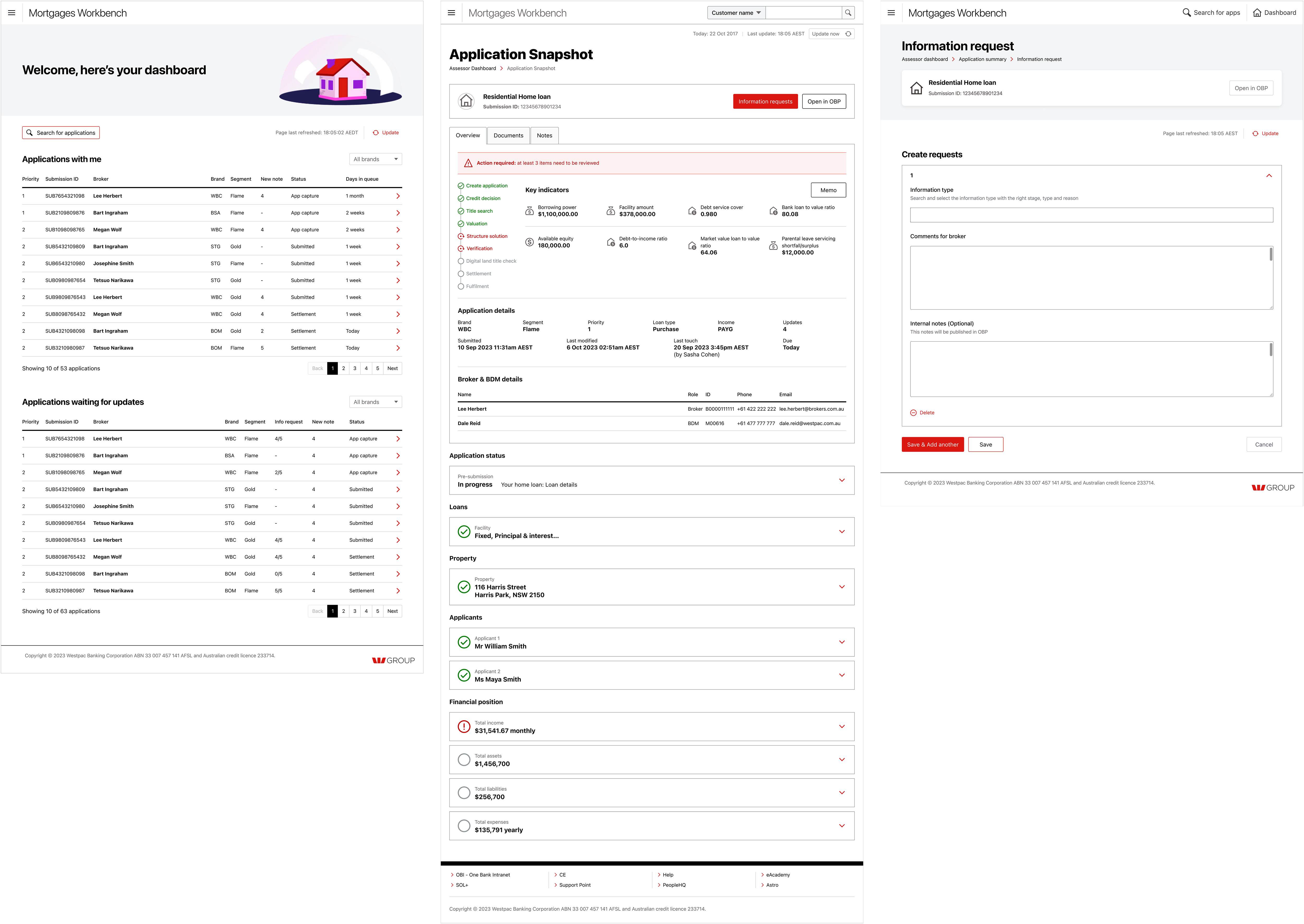

- Back office – applying user-centric principles to improve decision-making and streamline back-office operations

Research and insights

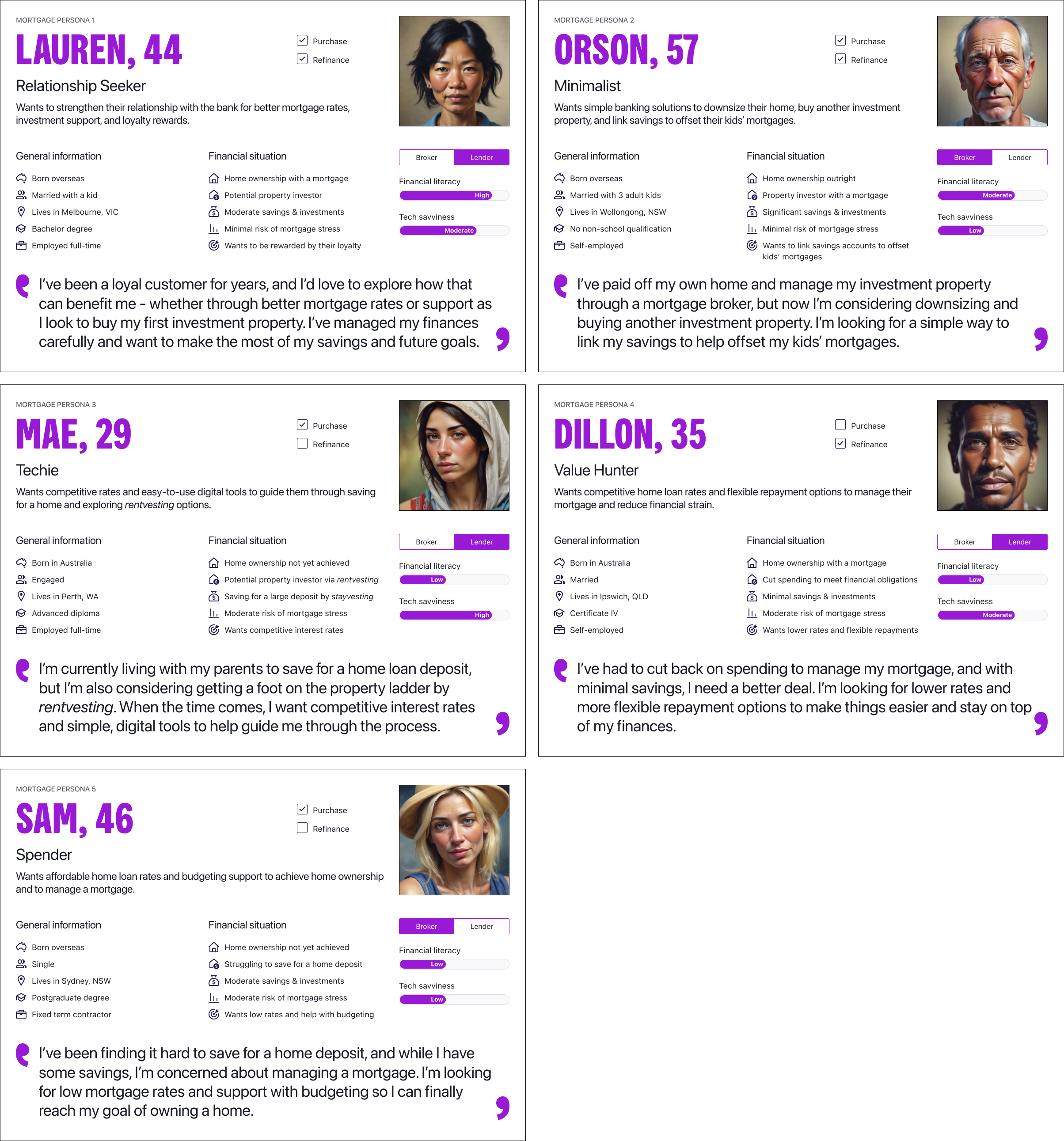

Extensive user research and data analysis are integral to the initiative, employing methods such as:

- Market research – benchmarking competitors to identify industry best practices

- Interviews and surveys – capturing feedback from customers, brokers, and staff

- Content audits and usability testing – evaluating current pain points and validating new design concepts

This research is informing the creation of a product roadmap and design strategy, with ongoing feedback loops to adapt to evolving insights.

Key business objectives

The transformation aims to achieve measurable outcomes, including:

- Achieving annual targets for digital mortgage settlements across Westpac and its regional brands

- Reducing application submission times and decision-making turnaround (from submission to unconditional approval)

- Improving Net Promoter Scores (NPS) for both customers and brokers

Solutions delivered

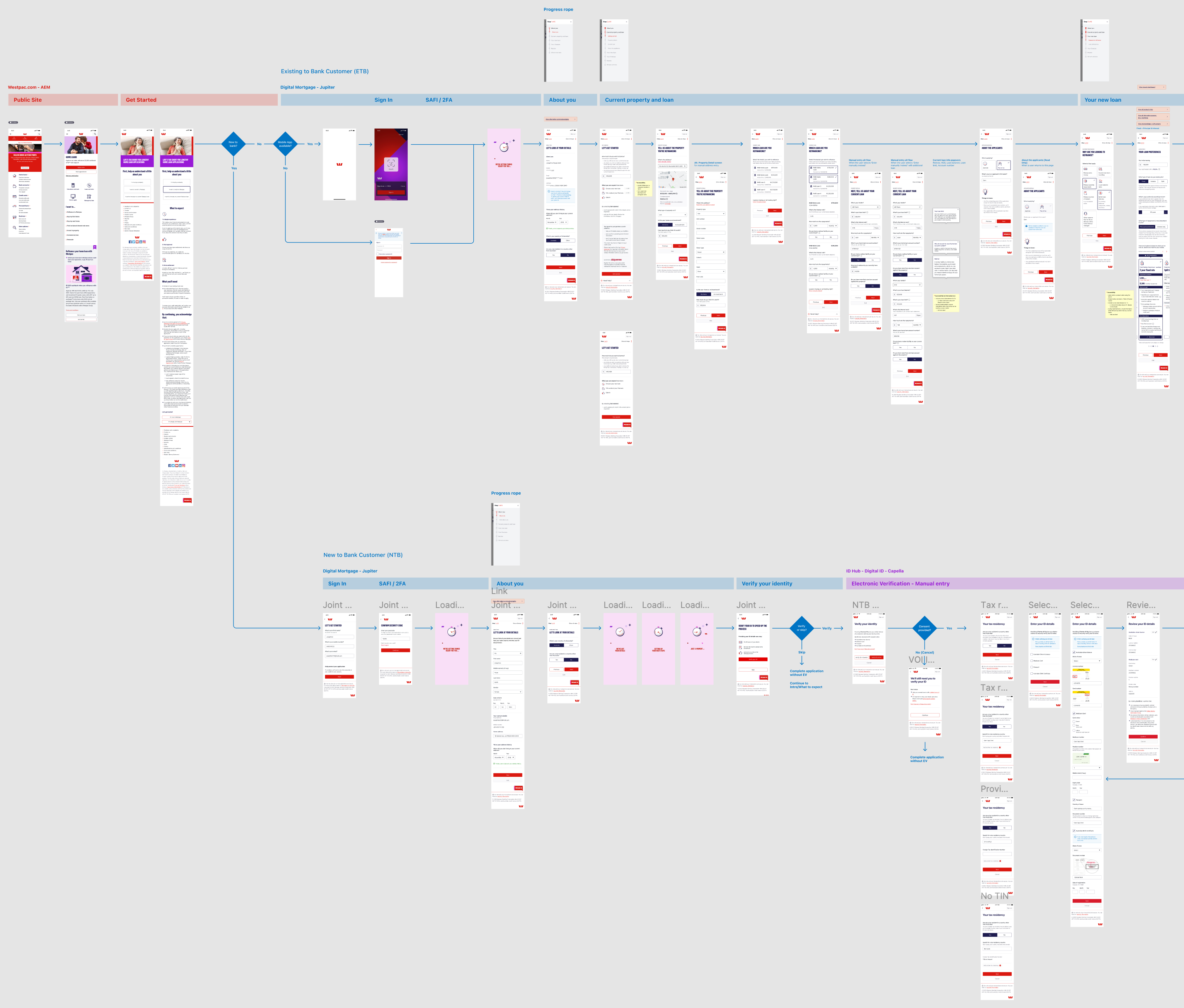

To meet these goals, the initiative is focusing on:

- Straight-through approval pathway – streamlining processes to enable faster decisions

- Simplified user journey – minimising complexity within the constraints of existing systems

- Enhanced application experiences – improving workflows for lenders and brokers up to submission and settlement stages

- Back office platform – introducing a new system to reduce the time required for application assessment

Impact

The first release went live in August 2022, with quarterly updates continuing since then. The transformation is already showing promising results:

- Financial impact – Westpac has achieved $3.4 billion in digital mortgage settlements in FY24, a $2.5 billion increase over the previous year

- Operational efficiency – significant reductions in processing time are being observed across the application lifecycle

- Customer and broker satisfaction – marked improvements in NPS scores for both groups

Conclusion

This project is showcasing the power of user-centred design and cross-functional collaboration to deliver meaningful business outcomes and superior user experiences. The success of the initiative underscores Westpac’s commitment to innovation and customer-centricity in the financial sector.

Work done at Westpac.

Project link