BT’s retail life insurance

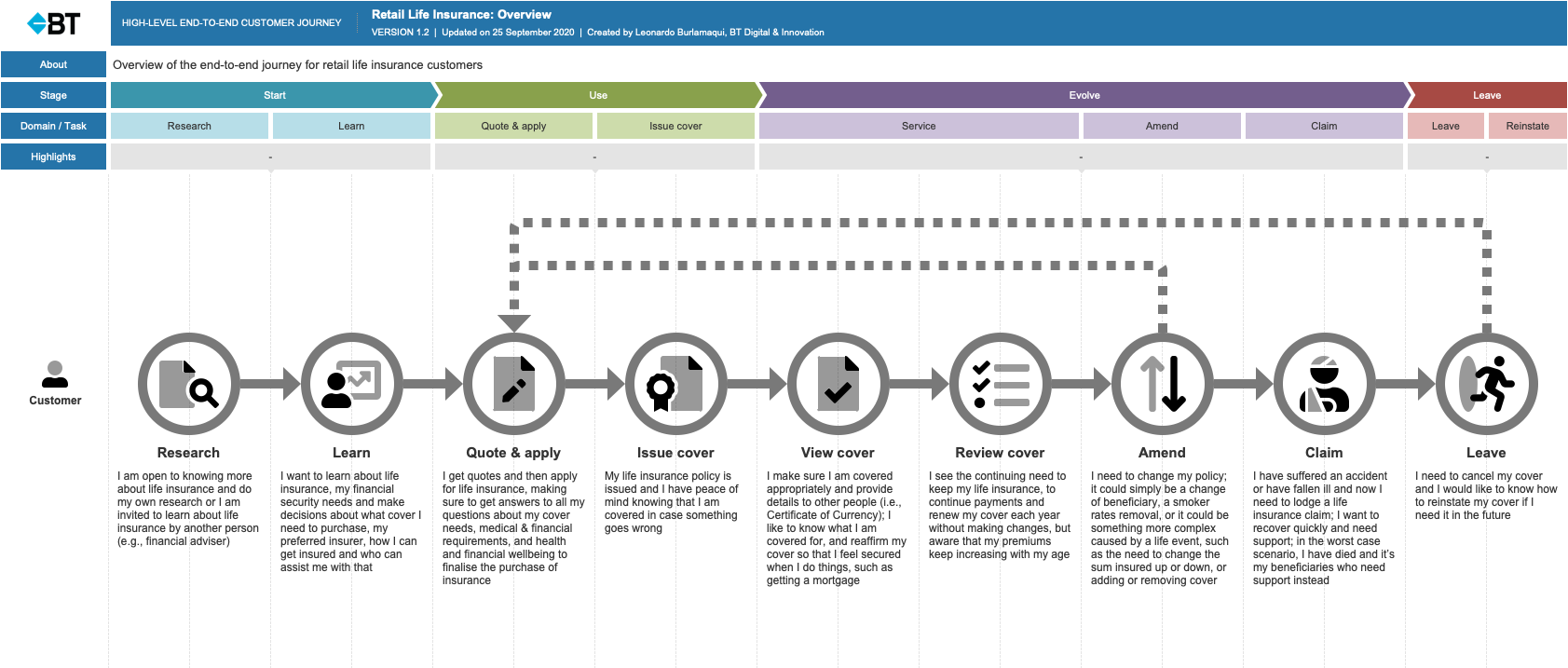

The purpose of this discovery work was to shed light on the existing customer journeys in the context of BT’s retail life insurance products, so these products could be redesigned to best suit the customer needs. To achieve that, those journeys had to uncover gaps, and identify pain points and constraints that could negatively impact the customer experience.

A number of workshops with stakeholders were run to establish their vision, gather high-level business requirements and understand their views around the existing customer journeys. The workshops included the following Design Thinking techniques:

1. Value Proposition Canvas

2. Problem Statement & Business Objectives

3. 5 E’s of Customer Journey

Then, a number of one-on-one interviews with life insurance customers and financial planners were carried out to understand their typical needs, goals and expectations, and to identify points of friction. The information collected was then discussed and validated with SME’s, who later took part in co-design sessions to build some rough end-to-end customer journeys. Additional sessions were held to further detail and improve those journeys.

The resulting suite of high-level end-to-end customer journeys set the groundwork for more detailed customer journeys and new rounds of customer research focused on each type of life insurance.